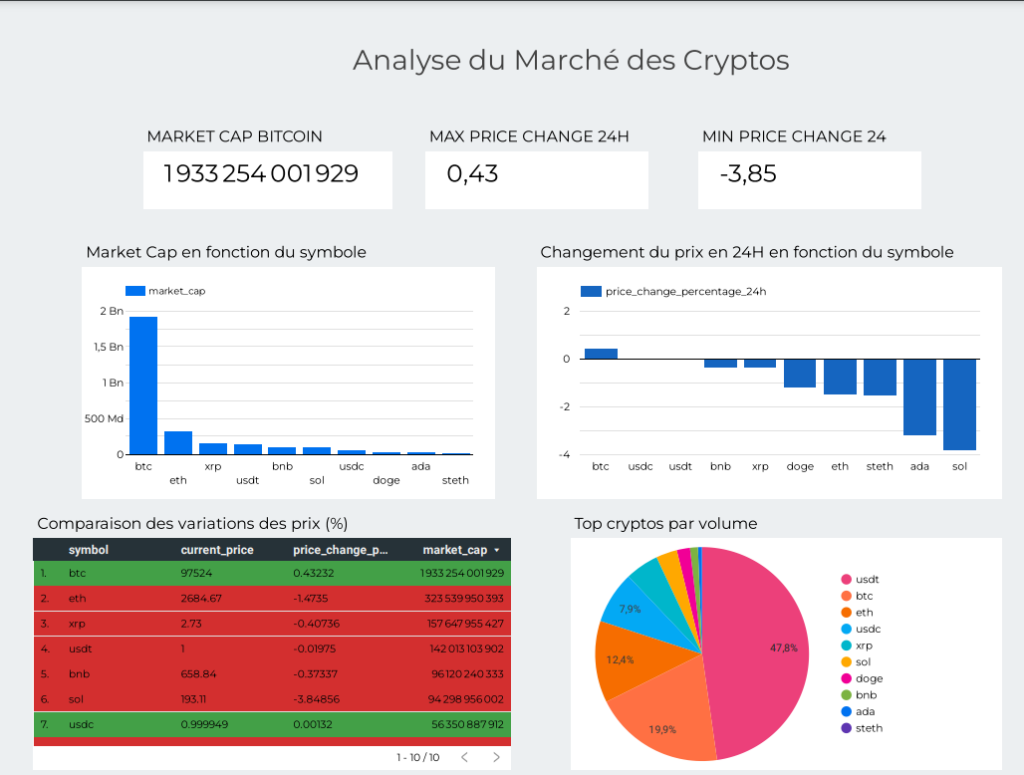

Cryptocurrency markets generate vast amounts of real-time data, including price fluctuations, trading volumes, and historical trends. Investors and analysts need clean, structured, and up-to-date data to make informed decisions. This project builds an automated ETL pipeline to collect, transform, and store crypto market data for analytics and visualization.